Supreme Court Refers Question On Applicability Of S.153 To Proceeding U/S 144C Income Tax Act Regarding Limitation Period To Larger Bench

The Supreme Court has referred the question on applicability of Section 153 of the Income Tax Act, 1961 (ITA) to a proceeding under Section 144C of ITA namely whether the period of eleven months should be over and above the limitation prescribed, to a larger Bench.

The Court was hearing Civil Appeals in which the dispute raised the important questions of law relating to the interpretation and interplay between Section 144C and Section 153(3) of ITA, more specifically, what are the periods of limitations prescribed for the revenue authorities to take action against an assessee and how the limitation periods and procedures prescribed in these two Sections coexist.

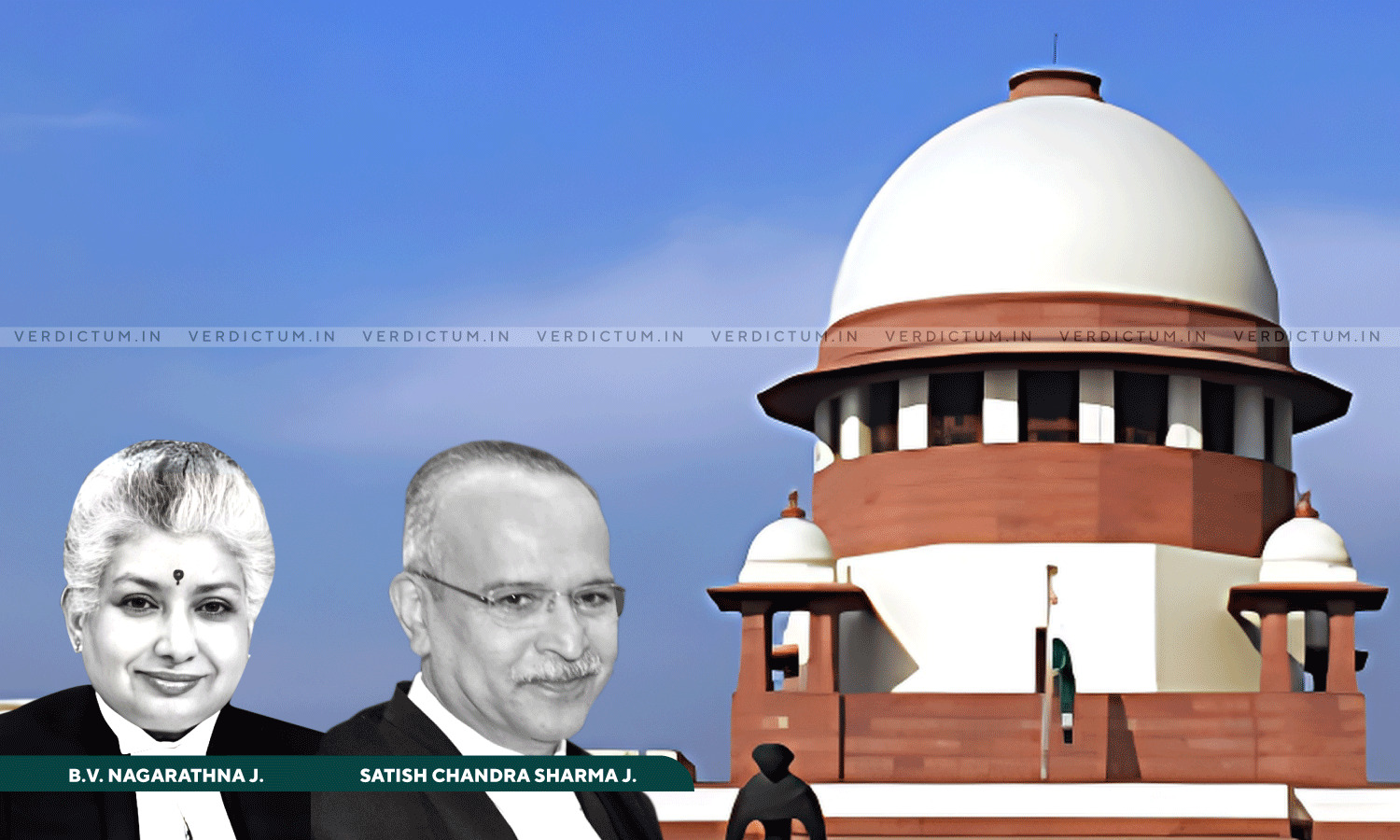

The two-Judge Bench ordered, “Having regard to the divergent opinions expressed by us, we direct the Registry to place these matters before Hon’ble the Chief Justice of India for constituting an appropriate Bench to consider the issues which arise in these matters afresh.”

Justice B.V. Nagarathna was of the view that the expressions “assessment” used in Section 143 ITA and “make an assessment of the total income or loss of the assessee, and determine the sum payable by him or refund of any amount due to him on the basis of such assessment”, and the expression “the assessment” in sub-section (13) of Section 144C as well as the expression “assessment order” in sub-section (4) of Section 144C have to be given an identical meaning under Section 153, i.e., final assessment order although, the assessment orders are made in a distinct manner and under a different procedure as they apply to different categories of assessees.

On the other hand, Justice Satish Chandra Sharma observed, “The fixed time periods prescribed under Section 144C of the Income Tax Act must be adhered to, and a final assessment order must be passed either within one month of the Draft Assessment Order if the situation contemplated under Sub Section (4) takes place, or within a period of 11 months from the passing of the Draft Assessment Order if the Assessee opts to file objections before the Dispute Resolution Panel.”

Additional Solicitor General (ASG) N. Venkataraman appeared for the Appellants while Senior Advocate J.D. Mistry appeared for the Respondents.

Case Background

The Respondents in the first batch of cases were non-resident assessees engaged in the business of exploration in terms of Section 44BB of ITA and were eligible assessees within the meaning of Section 144C. The Respondents were a group of companies incorporated overseas, engaged in the business of shallow water drilling for clients engaged in the oil and gas industry and have been filing their return of income. Four Special Leave Petitions (SLP) filed before the Supreme Court arose from four Writ Petitions preferred by the Respondents before the Bombay High Court, which were allowed. The Respondents in this case had the option to compute their income on presumptive basis under Section 44BB, however for Assessment Year (AY) 2014-15, they opted out of the option to compute their income on presumptive basis and declared a total loss of Rs. 1,20,18,44,672/- in their Return of Income filed in November 2014.

Vide notice issued under Section 143(2), their return of income was selected for scrutiny and subsequently, the Draft Assessment Order (DAO) was issued in 2016, computing the Respondents’ total income at Rs. 4,34,79,980/-. Objections were filed against the same before the Dispute Resolution Panel (DRP), which eventually did not accept their case and gave directions to the Assessing Officer (AO). Aggrieved by the AO’s final assessment order, the Respondents filed an Appeal before the Income Tax Appellate Tribunal (ITAT), which allowed the same and remanded the case to AO.

Finally in 2021, a show-cause notice (SCN) was issued to Respondents, who contended that no final assessment order could be passed now as the period of limitation expired on September 30, 2021 under Section 153(3) of the Act read with the provisions of the Taxation and other laws (Relaxation and Amendment of Certain Provisions) Act, 2020 (TOLA). Vide the common Order, the High Court concluded that there is no difference in the legal principle falling for consideration in all the Petitions, the draft order under Section 144C, and no final assessment order could forthwith be passed due to the expiry of due date. Being aggrieved by the said reasoning, the Revenue approached the Supreme Court.

Justice Nagarathna’s Observations

Justice Nagarathna in the above context of the case, noted, “… in so far as only an eligible assessee, as defined under sub-section 15 of Section 144C of the Act is concerned, notwithstanding anything to the contrary contained in the Act, if the Assessing Officer proposes to make, on or after 01.10.2009 any variation in the return which is prejudicial to the interest of such an assessee only a draft order has to be made and not a final assessment order.”

She said that the non-obstante clause in sub-section (1) of Section 144C has to be juxtaposed with reference to Section 143 of the Act and all other Sections which deal with making of an assessment order and this is because both Sections 143 and 144C deal with the passing of assessment orders depending on the category to which the assessee belongs.

“Sub-sections (4) and (13) of Section 144C when juxtaposed with Section 153 of the Act make it evident that they both deal with only the period of limitation in making an assessment order and not the manner of passing an assessment order”she added.

She further observed that an assessment order or an order of assessment encompasses the entire process of assessment commencing from the stage of filing of a return till the making of an assessment of the total income and also the determination of the taxes which is contemplated under Section 153 of the Act in so far as the limitation period for the said procedure is concerned and that is not exactly the exercise that is carried out under sub-section (1) of Section 144C as the said assessment order is not a final assessment order but only a draft assessment order.

“This is unlike assessment orders made under sub-section (3) of Section 143 or sub-section (13) of Section 144C of the Act which are final assessment orders. … In view of my aforesaid interpretation of Section 144C vis-à vis Section 153 of the Act, I arrive at the same conclusion as in W.P. 3059-3060/2021 by the Bombay High Court. … I therefore find that the High Court was right in allowing the writ petitions filed by the respondents-assessees by holding that no final assessment orders can be passed in these cases as the same would be time barred and hence the return of income filed by the respondents-assessees have to be accepted. I reiterate the same and also state that this would not preclude the Revenue from taking any other step in accordance with law”she concluded.

Justice Satish Sharma’s Observations

Justice Satish was of the view that when Section 144C operates not withstanding Section 153, and since the timelines under Section 144C are over and above the timelines under Section 153, Explanation 1 to Section 153 has no relevance.

“It is settled law that while interpreting statutes the Court must avoid an absurd interpretation and must always strive to interpret the provisions to ensure that the Legislation is not reduced to a futility, and the interpretation must ordinarily be such that it brings about an effective result which was intended by the Legislature”he reiterated.

He said that the two situations contemplated under the Income Tax Act in terms of assessment under Section 144C are vastly different and will obviously take varying amounts of time depending on whether objections are filed before the Dispute Resolution Panel or not.

“At the cost of repetition, it must be remembered that this option is only exercised by the Assessee. It is also relevant to mention that if adequate opportunity or time is not granted to an Assessee or if the Dispute Resolution Panel is forced to decide the objections in a very quick manner inhibited by the timelines prescribed under Section 153 of the Income Tax Act, it would amount to a violation of the Principles of Natural Justice”he added.

He, therefore, remarked that it is not possible to accept the view of the High Courts in this matter.

“Since I have been informed that this question of law and issue has arisen in a large number of appeals pending in various forums across the country, it is appropriate to clarify and specify the meaning of Section 144C of the Income Tax Act and its applicability alongside Section 153(3) of the Income Tax Act, including situations where Section 92C of the Income Tax Act is invoked”he also said.

He concluded that in cases of assessment proceedings under Section 144C, Section 153 of ITA and all its sub-sections are fully applicable, and the timelines prescribed therein apply to the Draft Assessment Order, which is to be passed under Sub Section (1) of Section 144C of the Income Tax Act and if proceedings under Section 92C are also invoked, the time period in view of Section 153(4) of the Income Tax Act would be extended by a period of 12 months.

Accordingly, in view of the divergent opinions expressed, the Apex Court directed the Registry to place these cases before the Chief Justice of India (CJI) for constituting an appropriate Bench to consider the issues afresh.

Cause Title- Assistant Commissioner of Income Tax (International Taxation) & Others v. Shelf Drilling Ron Tappmeyer Ltd. Etc. (Neutral Citation: 2025 INSC 946)