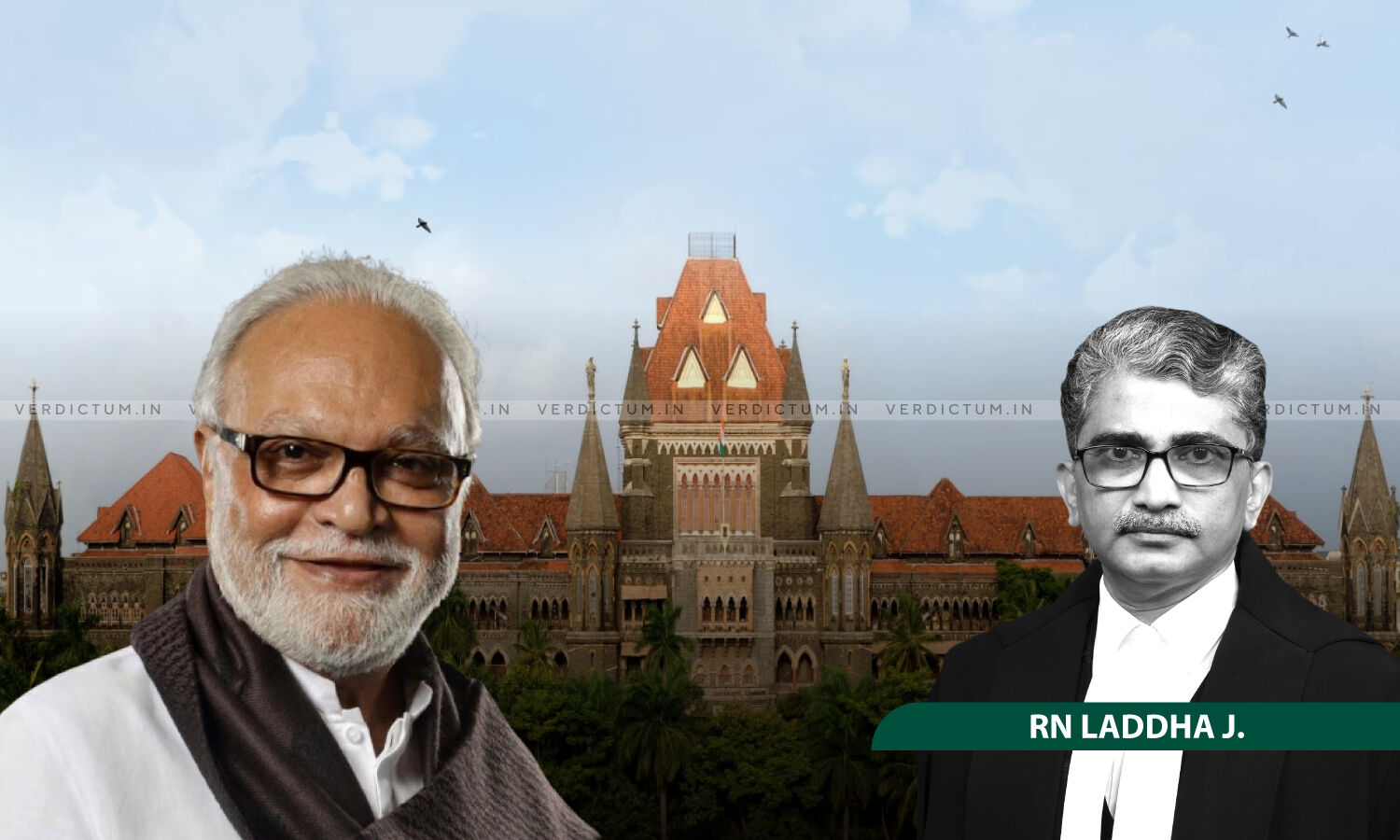

Bombay High Court Discharges NCP Leader Chhagan Bhujbal’s CA In Money Laundering Case

The Bombay High Court has discharged NCP Leader Chhagan Bhujbal’s chartered accountant in a money laundering case, holding that there was no material to indicate that he knew of, or aided in, the handling of alleged proceeds of crime under Section 3 of the Prevention of Money Laundering Act, 2002 (PMLA).

A Single Bench of Justice R.N. Laddha observed, “The complaint lacks material to establish a nexus between the applicant and the alleged criminal conspiracy or money laundering activities. Moreover, the applicant has neither been named nor charge sheeted in the related crimes, which further reinforces the absence of any direct or indirect involvement in the purported criminal conduct.”

The Court added, “It is well established that mere suspicion, conjuncture or surmise, however grave, cannot form the basis for framing a charge. The material must disclose a reasonable degree of evidence pointing toward the involvement of accused in the alleged offence. In the absence of such credible material, the continuation of criminal proceedings would be legally untenable, procedurally improper, and would constitute an abuse of the process of law, undermine both the integrity of the judicial system and the rights of the individual.”

Senior Advocate Pranav Badheka appeared for the Applicant, while Additional Public Prosecutor S.S. Pednekar represented the Respondents.

Brief Facts

The Applicant herein, a Chartered Accountant by profession, was named as an accused in a prosecution initiated under the Prevention of Money Laundering Act, 2002 (PMLA), arising from alleged laundering of funds linked to acts of corruption and criminal misconduct involving former Maharashtra Minister Chhagan Bhujbal, his family members, and close associates. The money laundering investigation was based on scheduled offences under the Indian Penal Code, 1860, and the Prevention of Corruption Act, 1988, including alleged acts of bribery and illegal gratification in relation to public infrastructure contracts.

The Directorate of Enforcement alleged that the Petitioner, while auditing companies associated with the Bhujbals, failed to raise red flags regarding transactions that allegedly involved cash deposits, accommodation entries, and shell entities, and these transactions were claimed to constitute proceeds of crime as defined under Section 2(1)(u) of the PMLA. It was alleged that the Applicant’s conduct amounted to directly or indirectly assisting in concealment, possession, or use of such proceeds, thus attracting the offence under Section 3 read with Section 4 of the PMLA.

The Applicant served as auditor of certain entities between 2012 and 2015. However, the alleged acquisition and layering of proceeds of crime were said to have taken place prior to that period. The complaint did not attribute any amount of proceeds of crime to the Applicant, and he was not named in any scheduled offence. The Special Court rejected his application for discharge, relying primarily on financial disclosures and alleged omissions in audit reports.

Reasoning of the Court

The Court noted that the complaint contained no allegation or evidence suggesting that the applicant was knowingly involved in any laundering activity, stating, “In the present case, the complaint lacks material to establish a nexus between the applicant and the alleged criminal conspiracy or money laundering activities. The applicant has neither been named nor charge-sheeted in the related crimes, which further reinforces the absence of any direct or indirect involvement in the purported criminal conduct.”

The Court observed, “Compelling the applicant to undergo the rigors of a criminal trial, in the absence of any prima facie evidence, would not only be an abuse of the process of law but would also infringe upon the applicant’s fundamental rights under Article 21 of the Constitution of India.”

The Court noted that it would be unreasonable to expect the Applicant, merely by virtue of being an auditor, to assume the role of an investigator. “The role of an auditor is inherently distinct from that of an investigating agency, and it would be unjust to hold the applicant to such a standard without any supporting evidence”, the Court added.

The Bench further stated, “The documentary evidence relied upon by the prosecution, including Note No. 28 of the financial statements, does not conclusively establish any complicity on the part of the applicant. The said note is a disclosure made by the management as per the provisions of Section 211 of the Companies Act and cannot be construed as a finding or certification by the auditor.”

The Court pointed out that the ED’s own annexures showed “NIL” against the Applicant’s name in the table estimating the proceeds of crime, and that the Applicant had neither facilitated the placement nor layering of funds, nor was there any evidence that he derived any benefit from the alleged transactions.

The Bench observed, “Additionally, the prosecution, in its complaint, alleges that the proceeds of crime originated around the years 2007-2008. In contrast, the applicant’s professional engagement as an auditor was confined strictly to the financial years ending March 2012 to March 2015. This clear chronological gap between the purported origin of the illicit assets and the applicant’s period of audit involvement negates any rational or legal inference of a connection between two. The absence of temporal proximity significantly undermines any suggestion of complicity on the part of the applicant.”

The Court noted that apart from the bare assertions made in the complaint, there was no substantive material on record to demonstrate that the Applicant had any knowledge of the sham transactions or that he was in any way negligent in the discharge of his duties. “The complaint lacks material to establish a nexus between the applicant and the alleged criminal conspiracy or money laundering activities. Moreover, the applicant has neither been named nor charge sheeted in the related crimes, which further reinforces the absence of any direct or indirect involvement in the purported criminal conduct”, the Court added.

Accordingly, the Court set aside the order of the Special Court and discharged the Applicant.

Cause Title: Shyam Radhakrishna Malpani v. State of Maharashtra & Ors. (Neutral Citation: 2025:BHC-AS:23510)

Appearance:

Applicant: Senior Advocate Pranav Badheka; Advocate Aishwarya Sharma

Respondent: APP S.S. Pednekar; Advocates H.S. Venegavkar, Ayush Kedia, Nitin Sharma